Top 10 PCB Manufacturers Globally: A 2024 Deep Dive

Printed Circuit Boards (PCBs) are the unsung heroes of the modern world, the backbone of every electronic device we rely on. From smartphones and laptops to medical equipment and automotive systems, PCBs enable these technologies to function seamlessly. But who are the companies behind these critical components? In this article, we delve into the global landscape of PCB manufacturing, spotlighting the top 10 players shaping the industry. We'll explore their strengths, global reach, and contributions, focusing on the key manufacturers driving innovation and production. Let's uncover the companies that keep our technology connected and functional, including notable players like TTM Technologies and Sanmina.

Global PCB Market Overview

The global Printed Circuit Board (PCB) market is a cornerstone of the electronics industry, experiencing continuous growth driven by the increasing demand for electronic devices across various sectors. This overview examines the current state of the market, focusing on its size, growth trajectory, key influencing factors, regional distribution, and segmentation by industry.

The PCB market's expansion is intrinsically linked to the proliferation of electronic devices, including smartphones, computers, automotive electronics, industrial equipment, and medical devices. According to industry analysis, the global PCB market is estimated to reach significant value in 2024 and is projected to grow at a compound annual growth rate (CAGR) of around 5-7% over the next five years, showcasing a robust and steady ascent. This growth is fueled by the rapid pace of technological advancements and the increasing complexity of electronics.

Regional distribution within the PCB market is notably concentrated in Asia-Pacific (APAC), which dominates production due to a combination of factors, including lower manufacturing costs, a strong supply chain, and proximity to major electronics manufacturing hubs. Countries like China, Taiwan, South Korea, and Japan hold a major share of the global production capacity. However, other regions, such as North America and Europe, have their own significance, with emphasis on higher technology and specialization in high-end PCBs for aerospace, defense, and medical applications.

| Region | Market Share | Key Drivers | Key Challenges |

|---|---|---|---|

| Asia-Pacific (APAC) | ~70-80% | Lower manufacturing costs, established supply chain, proximity to electronics hubs | Price pressures, environmental concerns |

| North America | ~10-15% | Focus on high-technology PCBs, strong research and development | Higher labor costs, competition from APAC |

| Europe | ~10-15% | Specialization in automotive and industrial PCBs, environmental regulations | Fragmented market, economic uncertainties |

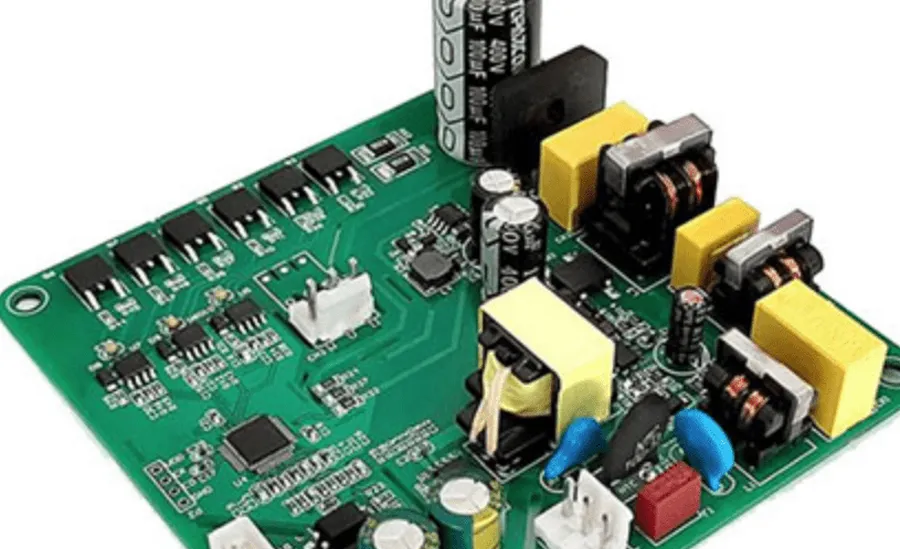

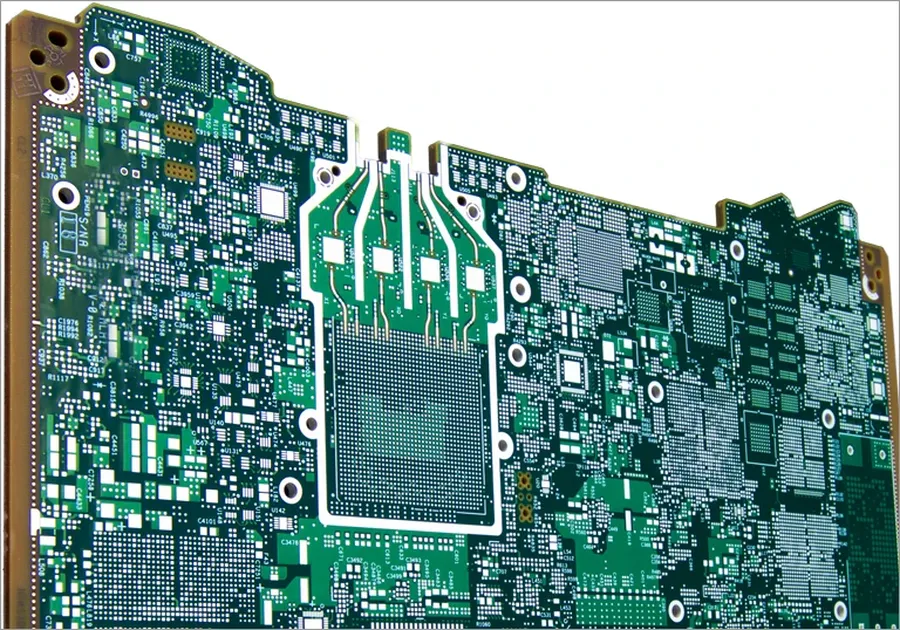

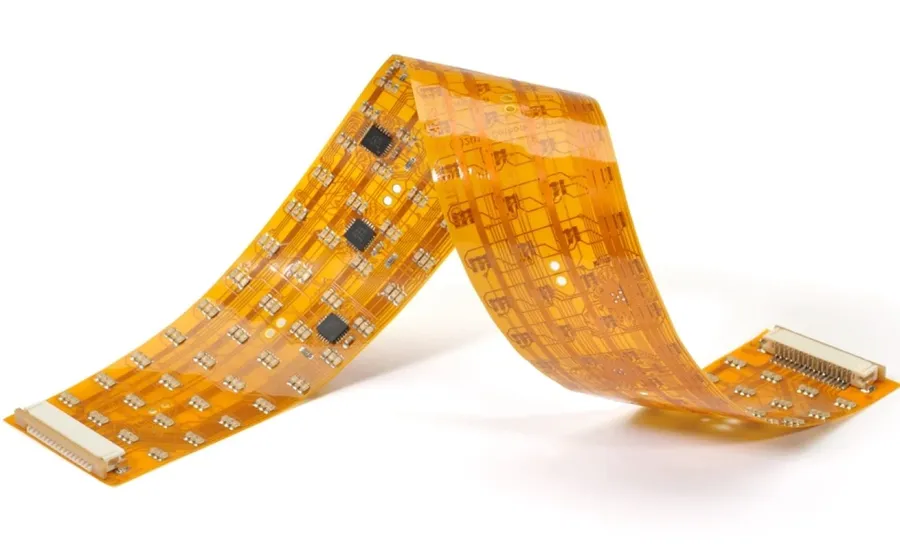

The market is further segmented based on the type of PCB and the end-use industry. Common types of PCBs include single-sided, double-sided, multi-layer, rigid, flexible, and rigid-flex PCBs, each catering to specific application requirements. Key end-use industries include consumer electronics, automotive, industrial automation, telecommunications, medical equipment, and aerospace and defense. Each sector exhibits distinct demands and requirements, necessitating diverse manufacturing approaches and materials, thereby contributing to a complex and dynamic market environment.

Overall, the global PCB market is characterized by robust growth, strong regional concentration in APAC, and diverse market segmentation. Its growth is directly linked to the overall electronics industry, technological advancements, and the increasing need for complex, high-performance circuits. Understanding this market landscape is crucial for PCB manufacturers and stakeholders to strategically position themselves in this competitive industry.

Ranking Methodology for Top PCB Manufacturers

Identifying the leading PCB manufacturers requires a robust and multifaceted evaluation process. This ranking methodology considers several key factors, each weighted to reflect its significance in the competitive landscape of the printed circuit board industry. The assessment extends beyond mere financial metrics, incorporating technological prowess, production capabilities, and market reach to provide a comprehensive view of each manufacturer's standing.

| Ranking Factor | Description | Weighting |

|---|---|---|

| Annual Revenue | Total revenue generated from PCB sales, reflecting the overall market share and financial performance. | 30% |

| Production Volume | Quantity of PCBs manufactured annually, indicating the scale of operations and production capacity. | 25% |

| Technological Capabilities | Assessment of advanced manufacturing technologies, including HDI, flexible PCB, and advanced materials processing. | 25% |

| Geographic Reach | Distribution of manufacturing facilities and customer base across different regions, highlighting global presence. | 10% |

| Customer Base and Industry Focus | Diversity and prestige of clients across sectors like automotive, aerospace, and medical, reflecting specialized capabilities. | 10% |

Each criterion contributes uniquely to the overall assessment. Revenue, a primary indicator of market presence, is a key starting point, representing 30% of the total score, while production volume (25%) illustrates capacity. Technological capabilities, especially in advanced areas like HDI and flexible PCB, are crucial, also accounting for 25%, as they show a company’s commitment to innovation and ability to meet evolving needs. Geographic reach and the diversity of the customer base, each contributing 10%, indicate a manufacturer’s global presence and ability to cater to demanding sectors. This comprehensive methodology ensures that the top rankings are based on a combination of financial strength, operational scale, technical innovation and strategic market position.

TTM Technologies: A Leader in Advanced PCB Solutions

TTM Technologies stands as a prominent global manufacturer of printed circuit boards (PCBs), distinguished by its focus on advanced technology and a diverse product portfolio. The company's expertise spans a wide range of PCB types, catering to various high-performance applications and market sectors.

TTM's technological prowess is evident in its capabilities for producing complex, high-layer-count boards, as well as specialized PCBs for RF, microwave, and high-speed digital applications. This specialization allows TTM to serve industries with stringent performance requirements.

The company operates a global network of manufacturing facilities, allowing it to provide responsive and localized support to its worldwide customer base. This global footprint is a key asset for managing supply chains and delivering consistent quality across diverse regions.

TTM Technologies' key market segments include aerospace, defense, data centers, and communications, as well as automotive and industrial sectors. Each of these markets demands high-reliability and high-performance PCBs, aligning well with TTM's specialized manufacturing capabilities.

| Attribute | Description |

|---|---|

| Product Portfolio | Wide range of PCBs, including advanced high-layer-count, RF, microwave, and high-speed digital PCBs. |

| Technological Expertise | Specialized in complex and high-performance PCB manufacturing, with a focus on advanced materials and processes. |

| Global Footprint | Network of manufacturing facilities worldwide, ensuring localized support and supply chain responsiveness. |

| Key Market Segments | Aerospace, defense, data centers, communications, automotive, and industrial sectors. |

| Advanced PCB Capabilities | High-Density Interconnect (HDI), complex multilayer boards, and PCBs for specialized applications. |

Sanmina: Global Manufacturing Expertise in PCBs

Sanmina stands as a major player in the global PCB manufacturing landscape, distinguished by its expansive scale, robust supply chain, and comprehensive solutions across numerous industries. A key aspect of their operation is their significant involvement in Electronics Manufacturing Services (EMS), providing integrated manufacturing solutions that extend beyond just PCB fabrication.

Sanmina's global footprint allows them to effectively serve a diverse customer base, leveraging their manufacturing capabilities and supply chain expertise. Their EMS involvement positions them as a crucial partner for OEMs (Original Equipment Manufacturers), handling the complete manufacturing process from PCB production to final product assembly. This integrated approach enables greater control, consistency, and efficiency in the overall manufacturing process.

The strength of Sanmina lies in its ability to deliver high-quality PCBs on a large scale, while also providing flexibility in terms of technology and end-product requirements. They are equipped to handle complex PCB designs and cater to the rigorous demands of various sectors. Sanmina’s reputation is built on its commitment to quality, technological innovation, and a comprehensive approach to manufacturing solutions.

Other Key Global PCB Manufacturers

Beyond the leading PCB manufacturers, several other companies play crucial roles in the global supply chain, each with its own strengths and regional focus. These manufacturers contribute significantly to the industry's diversity and technological advancement. This section profiles some of the most notable players, including AT&S, Zhen Ding Technology, Unimicron, DSBJ, and Nippon Mektron.

- AT&S (Austria Technologie & Systemtechnik)

AT&S, headquartered in Austria, is a leading European PCB manufacturer. They are particularly known for their high-end PCB technologies, including HDI and substrate-like PCBs. AT&S serves a wide range of industries, with a strong focus on automotive, industrial, and medical applications. Their advanced research and development efforts keep them at the forefront of PCB technology. - Zhen Ding Technology

Zhen Ding Technology, based in Taiwan, is a global leader in flexible printed circuits (FPCs). They are a major supplier to the consumer electronics industry, particularly in smartphones and tablets. Zhen Ding is also expanding its capabilities into rigid PCBs and advanced interconnect solutions, leveraging their high-volume manufacturing expertise and strategic global presence. - Unimicron Technology Corp.

Unimicron, another Taiwan-based company, is a significant player in the global PCB market. They offer a broad range of PCB products, from standard multilayer PCBs to high-end HDI and IC substrates. Unimicron's strengths include their technological capabilities, manufacturing scale, and diverse customer base. Their large production capacity and advanced technology allows them to compete in multiple global markets. - DSBJ (Dingsheng Electronics)

DSBJ, based in China, has rapidly grown into a major PCB manufacturer. While they initially focused on consumer electronics, DSBJ has expanded into other sectors, including automotive and industrial applications. Their production volume has made them an important competitor in the global PCB market, emphasizing cost-effectiveness and quick turnaround times. - Nippon Mektron

Nippon Mektron, headquartered in Japan, is renowned for its advanced flexible printed circuits and high-reliability PCBs. They excel in providing specialized solutions for the automotive, aerospace, and medical industries. Nippon Mektron's long-standing reputation for quality and technical innovation positions them as a preferred partner for complex and high-performance PCB applications.

| Manufacturer | Regional Prominence | Area of Specialization |

|---|---|---|

| AT&S | Europe | HDI, Substrate-like PCBs, Automotive, Industrial, Medical |

| Zhen Ding Technology | Asia | Flexible Printed Circuits, Consumer Electronics |

| Unimicron | Asia | HDI, IC Substrates, Broad Range of PCBs |

| DSBJ | Asia | Consumer Electronics, Automotive, Industrial, High-Volume |

| Nippon Mektron | Asia | Flexible PCBs, High-Reliability PCBs, Automotive, Aerospace |

North American PCB Manufacturing Landscape

The North American PCB manufacturing sector presents a unique landscape characterized by a blend of mature markets and emerging technological demands. While facing challenges from global competition, particularly from Asian manufacturers, North American companies are leveraging innovation, automation, and specialized capabilities to maintain a strong presence. This section delves into the key factors shaping the region's PCB industry, focusing on U.S.-based companies, market trends, and technological advancements.

| Company | Headquarters | Key Strengths | Market Focus | Technological Expertise |

|---|---|---|---|---|

| TTM Technologies | USA | High-mix, high-complexity PCBs, Global reach | Aerospace, defense, medical, data center | HDI, RF/Microwave, Advanced materials |

| Sanmina | USA | Large-scale manufacturing, EMS capabilities | Various including industrial, automotive and medical | High-volume production, supply chain management |

| Advanced Circuits | USA | Quick-turn prototyping and small volume production | Diverse, including startups and research | Rapid prototyping, online quoting platform |

| Summit Interconnect | USA | High-reliability and advanced technology | Aerospace, defense, medical | Complex multilayer PCBs, rigid-flex circuits |

| Viasystems (now part of Sanmina) | USA | Large scale production with focus on automotive | Automotive | High volume, cost-effective solutions |

The North American PCB market is seeing a growing emphasis on high-reliability and technologically advanced boards, driven by the aerospace, defense, and medical sectors. This trend is pushing manufacturers to innovate in areas like HDI, embedded components, and flexible circuit technologies. There is also an increasing focus on sustainability and environmentally friendly manufacturing processes. Furthermore, the push for reshoring and nearshoring is a key dynamic influencing the region.

PCB Manufacturing Technology Trends

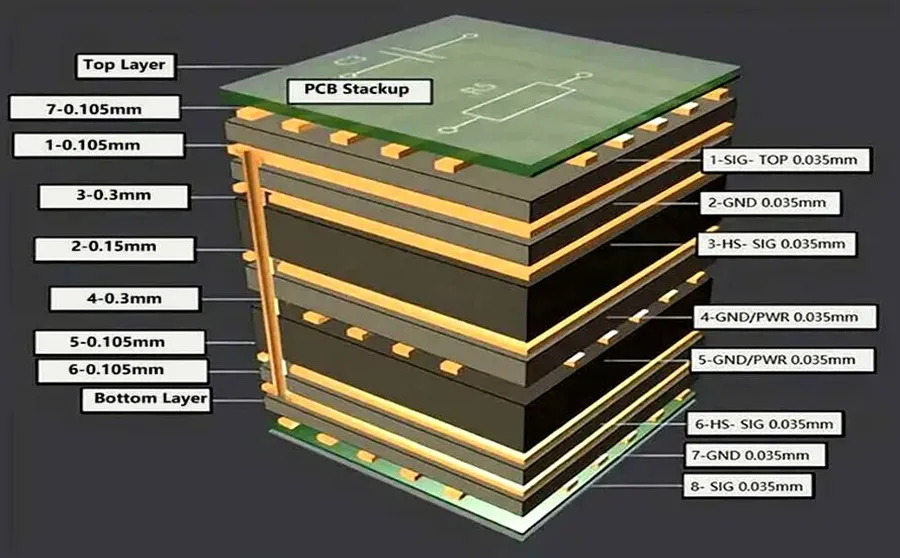

The printed circuit board (PCB) manufacturing landscape is undergoing rapid transformation, driven by the demand for smaller, more efficient, and higher-performing electronic devices. Key trends in PCB manufacturing technology include advancements in high-density interconnect (HDI), flexible PCB design, novel materials, and sustainable manufacturing practices. These innovations are fundamentally reshaping both manufacturing processes and product design.

| Technology Trend | Description | Impact on Manufacturing | Impact on Product Design |

|---|---|---|---|

| High-Density Interconnect (HDI) | Refers to PCBs with higher wiring density per unit area. Characterized by microvias, finer lines, and smaller spaces. | Requires advanced fabrication techniques, laser drilling, and precise layer registration. | Enables smaller form factors, increased functionality, and better signal integrity in products. |

| Flexible PCBs (Flex PCBs) | Made from flexible substrates like polyimide, allowing boards to bend and fold into compact spaces. | Demands unique handling during assembly, and often includes specialized adhesives and flexible connectors. | Permits integration in curved or irregular spaces, reduced weight, and improved reliability. |

| Advanced Materials | Includes new resin systems, fillers, and composites that enable improved thermal performance, mechanical stability, and signal integrity. | Requires optimization of processing parameters and may necessitate different manufacturing techniques. | Facilitates higher operating temperatures, faster data transfer rates, and better performance under stress. |

| Sustainable Manufacturing Practices | Focuses on reducing waste, energy consumption, and the use of harmful chemicals during PCB manufacturing. | Involves the implementation of eco-friendly materials, water recycling systems, and optimized manufacturing processes. | Encourages the use of renewable resources, extends product lifespan, and enables compliance with environmental regulations. |

Frequently Asked Questions about PCB Manufacturers

This section addresses frequently asked questions regarding PCB manufacturers, providing clarity on the best options for specific needs, specializations, regional leaders, and the geographical dynamics of PCB production.

- Who are the best PCB manufacturers for high-reliability applications?

For high-reliability applications such as aerospace, defense, and medical devices, manufacturers like TTM Technologies, Sanmina, and AT&S are often preferred due to their rigorous quality control processes, certifications, and experience in these demanding sectors. These companies possess robust testing capabilities and can adhere to strict industry standards. - Which PCB manufacturers specialize in flexible PCBs?

Nippon Mektron and Unimicron are recognized for their expertise in manufacturing flexible PCBs. These manufacturers have made significant investments in technologies that enable the production of flexible, high-density interconnects and are pioneers in this rapidly evolving market segment. They provide solutions for applications requiring bending and dynamic movement. - Who are the leading PCB manufacturers in North America?

While many global players have a presence in North America, key manufacturers with strong bases within the region include TTM Technologies and Sanmina. These companies have significant production facilities and long-standing relationships with North American customers. They understand the specific requirements and standards of the region. - Which country is the largest manufacturer of PCBs globally?

China is currently the largest manufacturer of PCBs globally, with a significant portion of global production. However, other Asian countries, such as Taiwan, South Korea and Japan, also play major roles in the supply chain. The concentration in Asia is due to the availability of cost-effective labor, established supply chains, and government support for the electronics manufacturing industry. - What are the key considerations when choosing a PCB manufacturer?

When selecting a PCB manufacturer, it’s crucial to consider factors such as the manufacturer's technical capabilities (e.g., minimum trace width, layer count, material compatibility), certifications (ISO, AS9100), production capacity, turnaround time, cost, and geographic location. Evaluating case studies of their previous work and seeking client testimonials is also beneficial. - Why is there a concentration of PCB manufacturing in Asia?

The concentration of PCB manufacturing in Asia is primarily due to a combination of factors, including lower labor costs, government incentives, mature supply chains, and a highly developed electronics manufacturing ecosystem. Additionally, close proximity to major electronics assembly hubs in the region creates significant logistical advantages. - Which PCB manufacturers are adopting sustainable manufacturing practices?

Several manufacturers, including some of the largest companies like TTM Technologies, Sanmina, and AT&S, are increasingly focusing on sustainable manufacturing. This includes using environmentally friendly materials, reducing waste, optimizing energy consumption, and complying with regulations like RoHS and REACH. While not all manufacturers have fully transitioned, the trend towards sustainability is growing.

Future Outlook of PCB Manufacturing

The PCB manufacturing sector is poised for significant transformation, driven by technological advancements, shifting geopolitical landscapes, and increasing environmental consciousness. This section explores the anticipated future trends, challenges, and opportunities that will shape the industry.

New technologies such as advanced materials, additive manufacturing, and AI-driven automation are expected to revolutionize PCB production processes, leading to higher density, enhanced performance, and more sustainable manufacturing practices.

Geopolitical factors, including trade policies, supply chain diversification, and national security concerns, are influencing the geographical distribution of PCB manufacturing. Manufacturers are adapting to the changing landscape by diversifying production locations and strengthening local supply chains.

Environmental regulations are pushing the industry toward more sustainable practices. This includes reducing waste, using eco-friendly materials, and developing energy-efficient manufacturing processes.

The future of PCB manufacturing will also be shaped by the evolving needs of end-use industries, particularly high-growth sectors like automotive, IoT, and 5G telecommunications. These sectors will demand PCBs with higher performance, greater reliability, and smaller form factors, driving innovation in materials, design, and fabrication technologies.

These factors combined present a complex and dynamic future for PCB manufacturers. Success will require companies to be agile, innovative, and adaptable, positioning themselves to lead through the coming changes.

The PCB industry is a dynamic and essential part of the global technology ecosystem. The top 10 PCB manufacturers, including TTM Technologies, Sanmina, and other global leaders, are at the forefront of innovation and manufacturing excellence, shaping the future of electronics across various sectors. As technology advances, the role of these manufacturers will continue to grow, requiring adaptation to new demands and techniques. Understanding the capabilities and contributions of these top manufacturers is crucial for businesses seeking cutting-edge solutions for their electronic products, especially with players like TTM Technologies and Sanmina leading the charge.

AnyPCBA

AnyPCBA